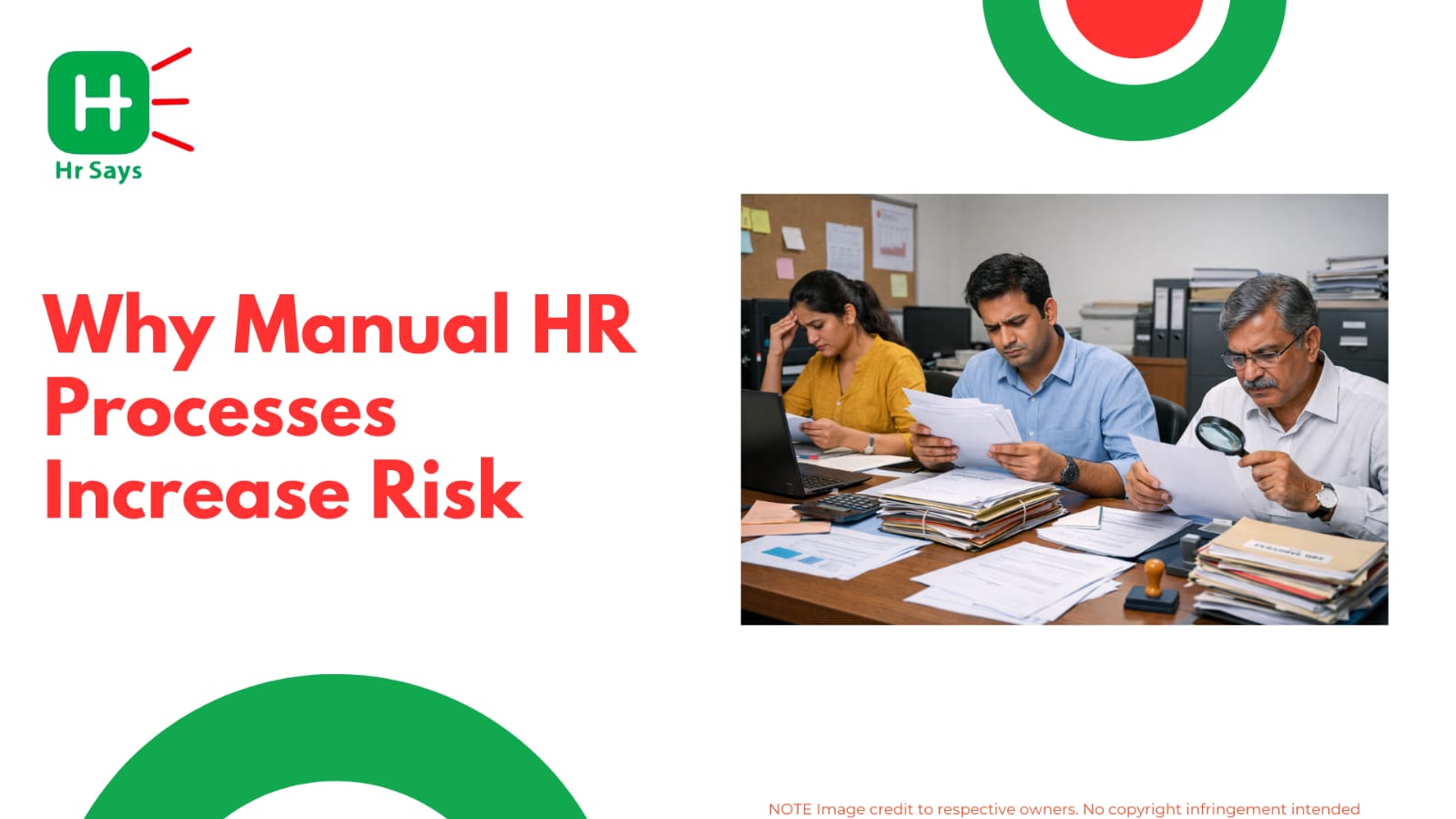

Historically small firms expand at a rate that is greater than the internal processes. Acquiescence is slipping through the cracks. Deadlines are missed. Rules are misunderstood. Periodic inspections will allow avoiding hefty fines but these measures are usually overlooked.

Poor Documentation Practices

Most small companies work under verbal approvals and files that are scattered around. Records stay incomplete. Audit trails get unclear. Policies remain unwritten.

Signs This Problem Exists

● Frequent last minute searches for documents

● Unclear ownership of approvals

● Missing signatures or outdated forms

How To Improve

● Centralise documents in secure digital folders

● Assign specific owners for record keeping

● Conduct monthly clean ups to keep files updated

Weak Data Protection Measures

Data protection remains a legal requirement and a trust marker. Small teams often delay formal security practices. This creates silent risks

Common Misses

● Weak passwords

● No encryption

● Irregular system updates

Practical Fix

● Implement basic security policies

● Train staff on data handling

● Review access rights quarterly

Misunderstanding Employment Compliance

Labour laws evolve. Roles change. Contracts stay outdated. This creates gaps. Small companies often skip structured HR processes due to time constraints.

Risk Areas

● Incomplete onboarding documents

● Incorrect classification of workers

● Lack of written policies

Simple Steps To Streamline

● Maintain updated employment contracts

● Document all HR policies clearly

● Track regulatory updates regularly

Inconsistent Financial Reporting

Many firms rely on a single person to manage accounts. Reports get delayed. Figures mismatch. Compliance grows vulnerable without structured reporting.

Issues Commonly Seen

● Unreconciled accounts

● Improper tax filings

● Missed statutory deadlines

Corrective Measures

● Schedule monthly financial reviews

● Use cloud based accounting tools

● Seek external audits when needed

Lack Of Routine Compliance Checks

Compliance is ongoing. It cannot stay limited to annual activities. Without routine checks, errors accumulate silently.

What Usually Gets Missed

● License renewals

● Policy updates

● Mandatory training sessions

How To Build Rhythm

● Create a compliance calendar

● Automate reminders

● Review processes quarterly

Conclusion

Compliance becomes manageable when approached in small steps. Early detection of gaps protects operational stability. Clear policies and simple habits help small companies build a dependable, risk free foundation.

.jpeg)

This blog highlights common compliance mistakes small companies make. It explains recurring

gaps, practical fixes, and routine habits that strengthen protection. The focus stays on clarity,

value, and simple improvement methods.

This blog highlights common compliance mistakes small companies make. It explains recurring

gaps, practical fixes, and routine habits that strengthen protection. The focus stays on clarity,

value, and simple improvement methods.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)